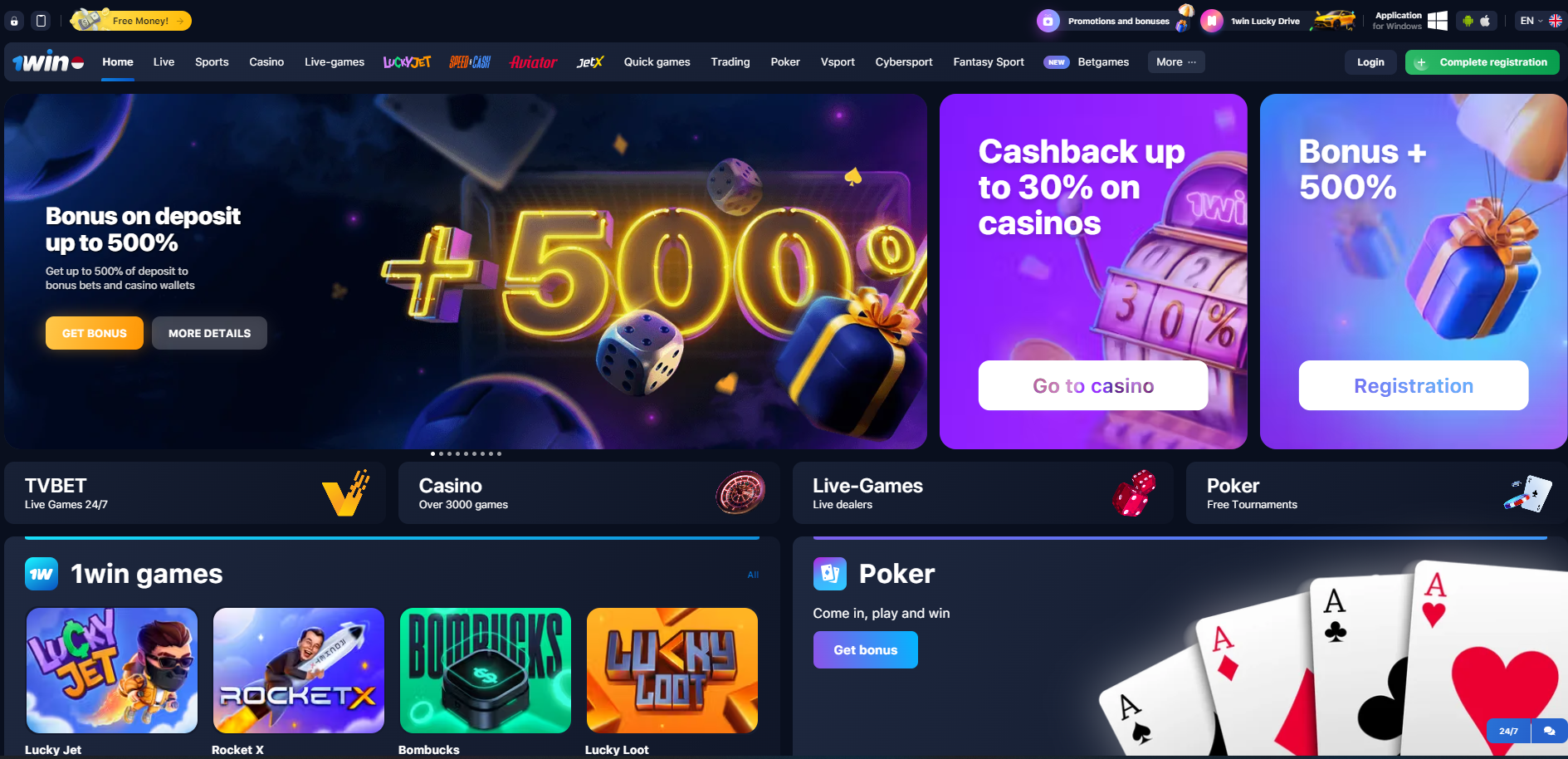

1win – Best Online Casino and Betting in India. Join & Login get 500% bonus.

In India, 1Win is the most well-liked online betting site. This website provides users with access to a vast selection of thrilling games, including poker, slots, casino, sports betting, and many more. Players may expect engaging experiences from 1Win thanks to its user-friendly and welcoming website layout, competitive odds, and several alluring promos. Players only need to download the 1Win app to their smartphone or visit the most recent 1Win link in order to engage in betting on 1Win.

Why should you choose 1Win Bet?

1Win is a betting website that was set up in 2016 and is run by Curacao eGaming. This guarantees that all actions on 1Win happen in a transparent, public and user-safe manner. Thanks to the following exceptional benefits, 1Win has grown to be the most well-known betting location in India after many years of operation and presence in several other countries:

- Diverse betting games

With a wide variety of gaming options and betting options the 1Win betting platform offers your favorite games are available for you to select from and enjoy here. Sports betting is available for events all over the world if you’re a sports fan. You can play Blackjack, Baccarat, Roulette and Poker if you enjoy gambling at casinos. Alternatively, you can amuse yourself with 1Win’s unique games, Quick games, or slots.

- Beautiful interface

The stunning and user-friendly design is only one of the main benefits that draw gamers to 1Win Bet. The website is multilingual and has an intuitive user interface and is styled in an accessible way. Users may quickly find the games they wish to play by looking at the list of significant games that is conveniently found on the menu. Specifically, 1Win’s interface has apps made especially for mobile phones and is compatible with a wide range of devices.

- Deposit/withdraw money quickly

You may feel totally secure about deposits and withdrawals with 1Win. Because a wide range of secure and adaptable payment options, such as bank transfers, Visa/MasterCard cards, e-wallets, online payment gateways and cryptocurrencies are supported by this website. The speed at which transactions are processed ensures that gamers never have to wait long. In addition, 1Win promises to keep all transaction information completely secret and does not charge any fees to users.

- High safety and security

1Win has always placed a high priority on matters of safety and data protection. 1Win has implemented the most innovative security measures currently available to provide players with total peace of mind while betting online. User information is all stored in a completely safe environment with stringent access controls in place and encrypted using 128-bit SSL technology. A strong and transparent privacy policy is also built by 1Win.

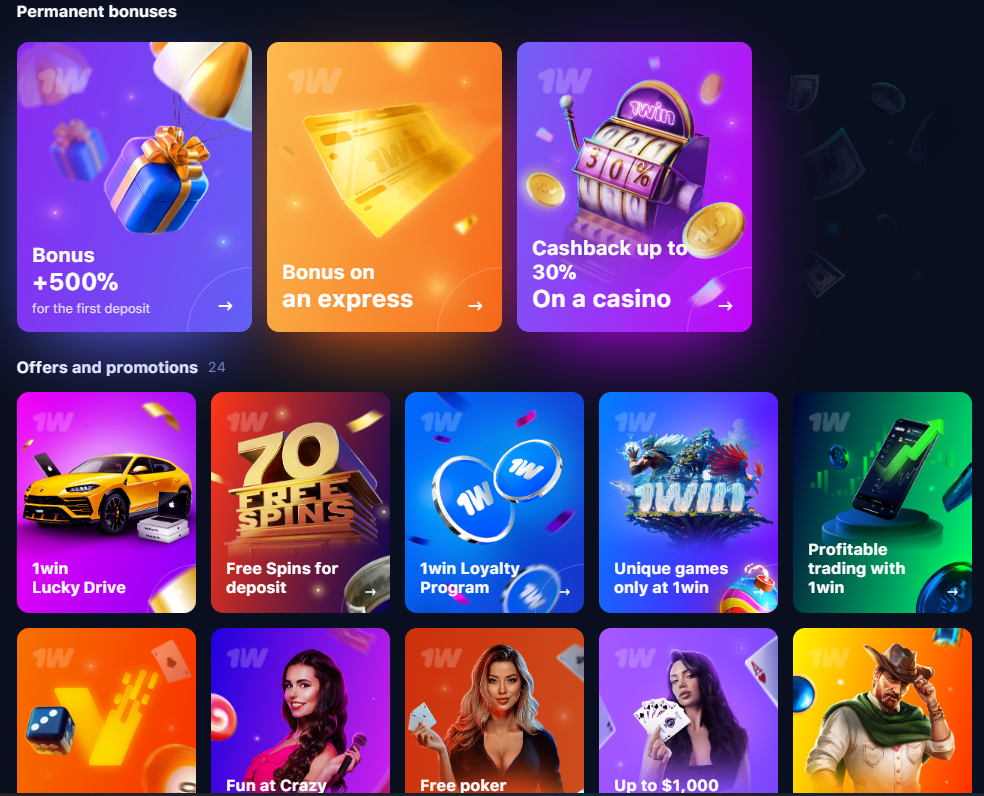

Latest promotions of 1Win India

In recent years, 1Win has constantly introduced alluring promos to draw in a sizable player base and satisfy them. The following are just a few of many 1Win India’s amazing player promotion programs:

- Enjoy a welcome offer of up to 500% on your first 4 deposits when you play sports betting and casino games on 1Win. The largest bonus amount is $750. Once the player makes a successful deposit, the bonus will be promptly added to their account.

- Refund casino bets up to $490, with a range of 1% to 30%. The player’s total bets placed at the casino during the previous week will be the basis for calculating the return rate.

- Refunds for bets up to 50% when playing poker on 1Win and up to 15% while playing games on Bet Games.

- Use the 1Win official website to engage in fast betting. Players who win 5 or more events will get bonuses ranging from 7 to 15 percent.

You can check out these and many more attractive deals and offers from 1Win Online straight on the 1Win.com website. In addition, 1Win often hosts competitions to foster more communication between players and bookies while giving winners the chance to take home several fantastic prizes.

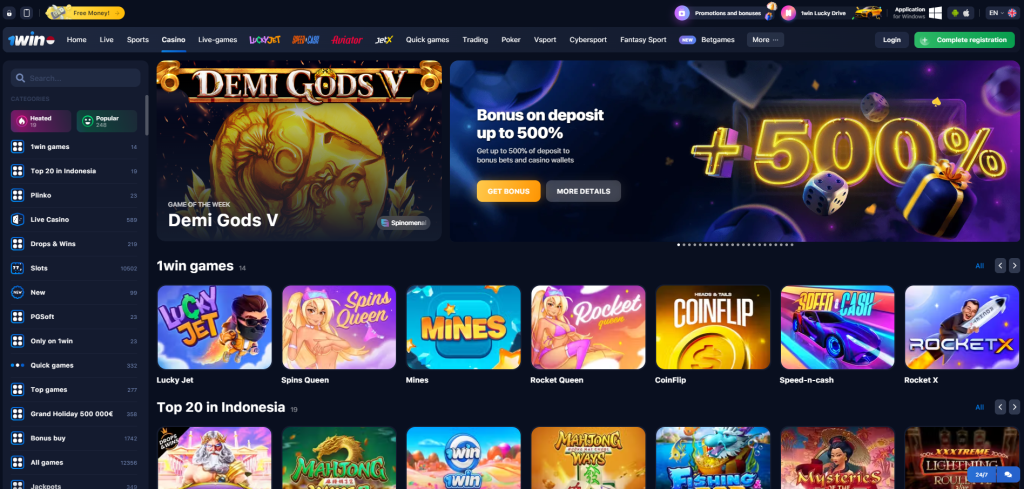

Popular betting games on 1Win

Participants can pick and play their preferred games at will when visiting 1Win India. Live casino games, poker, slots, sports betting, Aviator, Quick Game, and several more games are notable examples of these. The world-renowned game suppliers are the source of every game that 1Win offers. 1Win Online Casino is devoted to offering fair odds, alluring promos, and prompt payments to all players.

-

Sports betting

Players on the 1Win sports betting platform may bet on every sporting event taking place in the world, from minor competitions to major events like the Bundesliga, Serie A, La Liga, and English Premier League. 1Win offers coverage for all your favorite sports, including ice hockey, basketball, volleyball, tennis, and soccer. Players can check and make correct betting selections thanks to the constant updating of match information. Furthermore, 1Win offers a live betting function that lets users place bets throughout the game.

-

Live casino

1Win Casino is a fantastic choice for you if you enjoy playing at online casinos. More than 400 live casino games, including Baccarat, Blackjack, Roulette, Sico, and many more, are available for gamers to experience here. The casino rooms have a very contemporary layout, crisp screen, vibrant sound, and live dealers at every table. Through live video, players may completely engage with attractive, charming dealers from Europe and Asia, giving the impression that they are playing at a genuine casino.

-

Slot Games

One of the most played games on 1Win is the slot machine. With more than 10,000 slot games including a variety of themes, from classic slots to video slots and 3D slots, all from well-known game producers worldwide. Beautiful visuals, vibrant music, and several alluring features including jackpot prizes, bonus features, wild symbols, free spins, and bonus features are all featured in the game’s interface design. Slot games at 1Win Casino promise to deliver thrilling adventures and an excellent experience that lets you unwind and have fun after a demanding workday.

-

Quick Games

One of the newest and most played games on 1Win is Quick Games. This is a luck-based betting game that everyone can play since it has an easy to learn gameplay and a great winning potential. The brief duration of the games creates a dramatic, thrilling, and very alluring atmosphere. The majority of 1Win’s Quick Games have stunning visuals, lively audio, and device compatibility.

-

1Win Games

Along with well-known titles from the top game publishers worldwide, 1Win also publishes original games with lots of eye-catching features to give players fresh experiences and significant winning chances. Have fun. The games Lucky Jet, Rocket Queen, Coinflip, Mines, Aviator, and more are only available on 1Win. Players that take part in 1Win Games may take advantage of several exclusive bonuses from 1Win.

1Win App

1Win has introduced a specialized mobile application for iOS and Android operating systems, enabling users to place bets whenever and wherever they want, all while providing the finest possible experience for gamers. The following benefits of 1 Win App have made it extremely popular among players since its release:

- The 1Win App is simple to use, has an appealing UI, eye-catching graphics, and a modern look. In just a few effortless steps, players may quickly find their favorite sports and place wagers.

- Multi-language support is one of 1Win App’s best features. It is simple to select the preferred language and alter the UI to suit individual tastes.

- Like the web version, the 1Win App offers complete support for all betting games, including sports betting, live casino, slot machines, poker, and many more.

- With a few effortless steps, players can manage their accounts, follow their betting history, make deposits and withdrawals directly from their phones, and stay up to speed with the latest information by using the 1Win application.

- Specifically, 1Win offers a plethora of promos and limited-time deals to gamers who use its mobile applications. You have the chance to invest more money and place larger bets with this possibility.

24/7 customer service at 1Win

The customer care staff at the 1Win betting website is very skilled in resolving issues about account opening, deposits, withdrawals, rewards, promotions, and other related areas. They are also well-versed in the products and services they offer. They can respond to inquiries in a variety of languages and are always available to aid clients around-the-clock. The support team at 1Win may be reached via email, phone, or live chat on the website. The 1Win support staff will reply to requests as soon as they are received, so gamers won’t have to wait long.

Players can get in touch with 1Win India using the following modes of communication:

- Chat directly on the website

- Email: [email protected]

- Telegram

FAQ

1. Is 1Win legal in India?

1Win is a global bookmaker that specializes in offering online betting games and has a license from Curacao eGaming. Every action taken by 1Win follows local and international laws governing online betting as well as those of the nation in which it conducts business. As a result, you may feel secure when betting on 1Win India.

2. How to register for a 1Win account?

The steps to register an account on 1Win India are amazingly simple, you just need to follow these instructions:

- Step 1: Visit 1Win’s official website, click the “Register” button on the home page.

- Step 2: Fill in all personal information as needed, including: account name, password, phone number, Email. Or you can register an account via social networks.

- Step 3: Carefully read the terms & conditions of using the 1Win website, then click the “Register” button to confirm and complete the account registration process.

3. How many 1Win accounts can I register?

Users are only allowed to create one account on 1Win, according to the 1Win policy. to reduce cheating and guarantee game fairness. The software will freeze an account, take wins out of it, and maybe even prohibit a player from using 1Win services if it finds out that they are creating many accounts. Therefore, prior to creating an account, thoroughly read the terms and conditions of use on the 1Win website.

4. Is there a fee to download the 1Win application?

Players may use their mobile devices to access 1Win and engage in betting at anytime, anywhere by downloading the 1Win application, which is compatible with both iOS and Android operating systems. Gamers may download the 1Win app to their phones at any time for free.

5. How to login 1Win?

To login to 1Win, players just need to use the latest 1Win login link we provide above or download the 1Win application to their phone to log in to their account at any time.